September 15, 2022, thousands of people anxiously watch live streams, data-tickers, Twitter, and other social media awaiting “The Merge,” a long-anticipated event that promises the future, everlasting prosperity, and endless opportunity.

For those following the Youtube live stream, at 6:43 am UTC, a cryptic message embedded in lines of code stating “PoS Activated” appears. Viewers applaud, cheer, and celebrate.

A New Order has begun (pun intended), or has it?

This sounds like the intro to the latest Sci-Fi Hollywood blockbuster, but no, it describes an actual event;

The change of the Ethereum (ETH) blockchain from Proof-of-Work to Proof-of-Stake.

Or, in other words, changing the operational fundamentals of the world’s second-largest blockchain from the ground up without disruption or downtime. And while this sounds like gibberish to most, for people interested in blockchain and crypto, this event marks a technological milestone comparable to changing a car’s engine while driving.

Detailing the pros and cons and comparing PoW and PoS is not the goal of this article, but if you want to learn more, look no further

So what about the new order; has the world genuinely changed since we woke up on this faithful September day? Well, let’s say not just yet.

The response to the “Merge” in terms of demand and price of ETH is what a financial analyst would call subdued or muted. But why? Well…, to answer this question, we need to dig a bit and look at the bigger picture.

Key Takeaways

- Negative economic sentiment is putting pressure on the demand for risk assets.

- Regulatory uncertainty about the new consensus mechanism hampers interest

- Sell-side pressure from miners liquidating stockpiles of ETH

- The merge is only the first step in the evolution of Ethereum

- Layer 2 solutions are on the rise reducing ETH demand

From my perspective, there are two forces at work; External factors that go beyond Ethereum’s influence and internal factors that are more directly linked to the project. So let’s break this down into bite-size junks.

External Factors

A Looming Economic Recession

To understand what this has to do with the ETH price, we need a quick refresher on basic economics.

After a decade of prosperity thanks to cheap money and widespread supporting measures, the world economy is becoming a victim of its own success. Labor shortages, geo-political conflicts, and post covid supply shortages increase prices for goods and services. At the same time, we have record amounts of money circulating. Simply put, there is too much money for too few goods. Meaning money is essentially cheap and goods expensive, aka inflation.

While some inflation is considered good for economic growth, runaway inflation is not. An effective way to combat inflation traditionally is for central banks to increase interest rates, making borrowing more expensive and incentivizing people to save money, i.e., to withdraw money from circulation, making it more valuable than goods.

On paper, this sounds like an easy fix. Well, let me tell you, it is not. Raising central bank rates fast and far to combat inflation risks backfiring and causing an economic recession. Why? High-interest rates will make your mortgage or company loan more expensive and reduce the chances of people entering the property market as buyers. More expensive capital for companies means they are likely to cut spending, and cutting loose employees is one way of curbing costs in the short run.

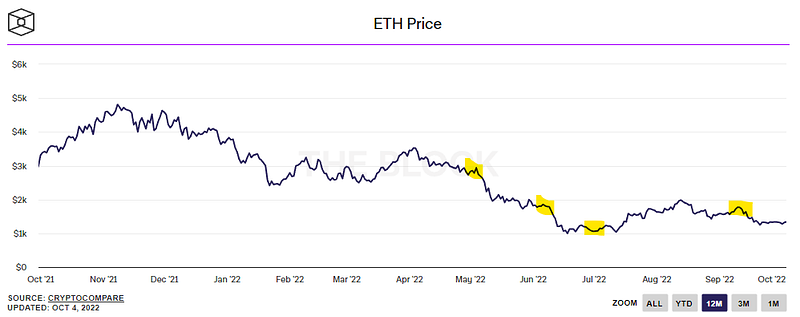

When people face an uncertain economic outlook, they sell off-off in risk assets and take profit from well-performing assets, leading to declines in prices for equities and, yes, you guessed it, cryptocurrencies.

A quick look at the 12m ETH-Price chart confirms that theory. The ETH price reacted negatively when the US Central Bank announced an interest rate hike (yellow markers).

Regulatory Pressures

Being under regulatory scrutiny is nothing new for the crypto world. Regulators all over the globe scramble to understand, safeguard and regulate crypto markets. Ethereum, with over $160bn market cap being the second largest cryptocurrency behind Bitcoin, is under the watchful eye of many, including the US CFTC and SEC, two of the world’s most powerful regulators.

Earlier in 2022, a US senate bill proposed that Bitcoin and Ethereum are classified as commodities and thus fall under the supervision of the CFTC. Although not explicitly mentioned, the argument goes that PoW currencies are “mined”, similar to traditional commodities such as gold. Securities, on the other hand, are “issued”.

With the move from PoW to PoS, the mining aspect of ETH gets lost, and it could lead to a renewed push from the SEC to gain control by declaring ETH 2.0 as securities.

This regulatory uncertainty is counterproductive and lets many investors remain on the sideline or exit positions until the situation becomes more apparent. Especially prominent institutional players can’t afford to get caught being on the wrong side of the fence when regulatory titans clash.

Internal Factors

Jobless Miners

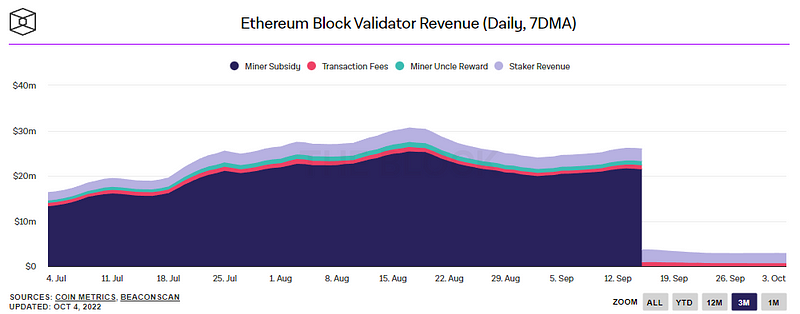

Although the Merge was on the horizon for years, many large-scale ETH minors remained operational until D-Day. But on this faithful September at 6.43 am UCT, the mine shafts were shut and sealed for good.

Now that mining ETH is no longer an option, miners will have to close down their operations or find another PoW-Token to focus on. Although the latter sounds like the logical step, there are complications to both approaches:

- Not all mining equipment is the same — GPU vs. ASIC Mining: Not all PoW blockchains require the same mining equipment; ETH mining is most efficient with graphic processing units (GPUs), BitCoin, on the other hand, relies on ASIC mining equipment. Details here; ASIC Miner vs. GPU Mining | What to Choose to Mine In 2022

- Shrinking Block Rewards: Too much mining power can destroy block rewards for miners. The amount of computing power becoming available surpasses the demand. Simply deploying these old ETH mining rigs on another chain will reduce the rewards paid for mining new blocks to a point where the cost/reward becomes unjustified.

- Closing Shop is Expensive; Even if a miner decides to shut its operations for good, this is not an overnight process. Many large-scale miners operate physical sites with leases, power contracts, employees, and other (financial) obligations. Even dismantling a farm and selling the components for scrap will cost money.

On-chain data shows that since the Merge miners sold roughly 16,000 ETH and CoinDesk estimates that miners still sit on another 245,000 ETH, coins they no longer have any business affiliation with. While it is unlikely that these stockpiles are being dumped all at once, they can still add negative price pressure to ETH over an extended period.

The Merge was only the Beginning

The change of the ETH consensus mechanism was merely the first step of many that aim to futureproof Ethereum. The Merge mainly impacted the energy consumption required to maintain the blockchain but had little effect on security or scalability.

Some sources say that abandoning ETH mining may have reduced global energy consumption by 0.2%. While this theoretically could be the case, the effects are likely to be short-lived as at least some miners will simply seek to redeploy their rigs elsewhere. Nevertheless, having the second-largest blockchain operating more energy-efficiently is undoubtedly a good start.

The burning questions around safety and scalability will be addressed in future updates, such as the sharding, in 2023/24.

Concerns over Centralization

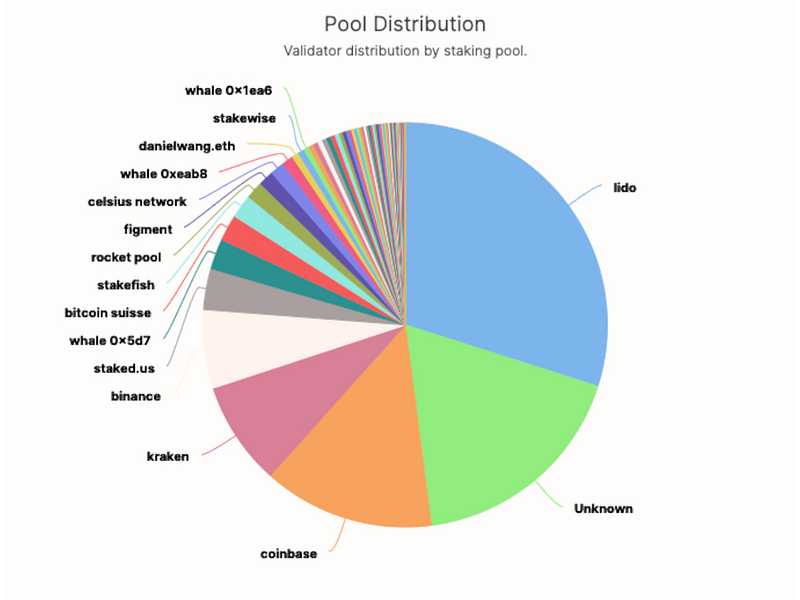

In the run-up to the change of consensus, concerns around the centralization of ETH started emerging. Post merge, most staked ETH sits with only five different owners, led by the staking protocol Lido.

This raises similar questions to Bitcoin, where a few minors control the market. However, there is a difference. Miners are physical entities owned by and controlled by individual operators, while staking pools are protocols sourced by many small contributors. In theory, those small participants can stop a validator from becoming too powerful by simply removing their assets.

Since most of the ETH in these protocols are still vested until the next update, these node operators could technically collaborate and influence the future of Ethereum without fearing a backlash from users. Although this is an improbable scenario (Lido in itself has several staking pools), a proof-of-work chain is not free from centralization issues.

It is now in the hands of the community to decide how (de)centralized Ethereum truly will be.

The rise of Layer solutions and Alt-Chains

The need for scalability and lower fees has pushed Layer 1 alternatives, especially since the sharding update for ETH is still 12–24 months out. Layer 2 solutions like Arbitrum, Optimism, and Loopring borrow the security of the Ethereum network but allow users to transact at a fraction of the cost. Other solutions like Solana and Polygon propose entire ecosystems with the promise of higher speeds, lower fees, and better efficiency.

While these solutions continue to enrich the overall Ethereum ecosystem, they divert interest away from the native ETH token, removing an essential catalyst for price.

A steady decline in Ethereum’s On-Chain Volume seems to confirm this thesis.

The End for Ethereum?

While all of these points may suggest that Ethereum is not in a good state, it is not all doom and gloom and certainly not the end of Ethereum.

Unlike many other cryptocurrencies, Ethereum has already weathered one crypto winter, and given its widespread adoption, it will most likely do so again. And while some say the world second largest cryptocurrency has become a victim of its own success, I see it as an achievement;

- The sheer magnitude and importance of the Ethereum merge stress the importance for regulators to clarify the classification question.

- Subdued demand and less risk-taking bring the focus back to actual development, utility projects, and, subsequently, true value.

- Some of the miners will likely shut for good and indeed reduce energy consumption (every bit helps)

- The Merge has shown that even large-scale projects can transform and evolve, even more impressively, without interruption.n

- Fears of centralization can, over time, be addressed by the community. This is the chance to show that decentralization truly works.

- Layer solutions, sharding, and alt-coins should not be seen as a threat but as an ecosystem expansion. If the whole system flourishes, so will Ethereum

Moreover, many projects still choose the Ethereum blockchain as their foundation, and upgrades like “The Merge” aim to ensure this remains true.

We must avoid thinking of “one chain to rule them all.” What we need is a diverse and interconnected ecosystem with layers, levels, chains, and solutions. We need a garden Eden that cross-pollinates, not a monoculture.

Take the Yellow Network, for example. Although initially rooted in Ethereum, the project seeks to interconnect the different silos and remove cross-chain trading barriers to build what is genuinely a third-generation Web.

So is all this fear-mongering at the beginning for nothing?

To be perfectly clear, my intention with this article is not to raise flags or point fingers. I merely wish to highlight the forces at play and help you understand the situation’s complexity.

The crypto market is undoubtedly in trying times, no doubt about it. But it is a time like these when winners are made. I believe Ethereum and its native token, ETH, have what it takes to stand the trial of time. Maybe the crazy days of triple-digit returns are over, but that does not mean it’s the end.

To circle back to my financial analyst analogy, Every growth stock that survives the trial of time will eventually be a value stock.

You might argue that blockchain and crypto are still growth markets, but at an atomic level, some projects are more mature than others. Or, as I would put it, Ethereum is a value stock in a growth market (Apple, anyone?).

And, at any time, I prefer a project aiming for long-term success over a quick buck.

For now, the external forces manage to keep a cap on the upside. Sometimes it has to get worse before it gets better.

A word from the Author

Thanks for reading!

I hope you had a good read on this independent analysis by Inside the Block for the Attirer. Feel free to contact me or kickstart a conversation in the comments!

Disclaimer: Any information in this article is based on my personal experience, out of personal interest, and to my best knowledge and ability. This article has no promotional purpose, does not represent investment advice, and any names, brands, and tickers mentioned in this article are for illustrative purposes only. Use any of the associated links with care and at your own risk. Always do your own research.

Discover Web3 and Dive into DeFi with Yellow Network!

Yellow powered by Openware is developing an unprecedented worldwide cross-chain P2P liquidity aggregator Yellow Network, designed to unite the crypto industry and provide global remittance services actually helpful to people.

Are you a crypto developer? Check out the OpenDAX v4 white-label cryptocurrency exchange software stack on GitHub, designed to launch market-ready crypto exchange brokerage platforms with a built-in liquidity stream.

Join the Yellow Community and dive into the most product-oriented crypto project of this decade:

- Follow Yellow Twitter

- Join Yellow Telegram

- Check out Yellow Discord

Stay tuned as Yellow Network unveils the development, technology, developer tools, crypto brokerage nodes software, and community liquidity mining!