Trading your own assets is great, but what if you could amplify your returns by borrowing assets, increasing your market leverage? The tools used by many professional traders in traditional financial markets, margin trading and leverage, have become more mainstream since the rise of cryptocurrency markets.

But with the prospect of significant returns comes great risk, especially for inexperienced traders that often tend to be highly overexposed and operate with a significant risk framework.

An article published by Coindesk on June 14th, 2022, shows how ruthless trading on margin can be. In less than 24 hours, falling cryptocurrency prices wiped out nearly $1bn worth of positions traded on margin and leverage.

Situations like these brutally show the risk of using leverage and trading on borrowed assets.

Acquiring a profound knowledge of the complexity, terminology, mechanics, benefits, and risk is vital when wanting to use margin trading and leverage. Let’s dive in and cover some basic 101 of Margin Trading and Leverage.

What is Margin Trading?

Margin trading is the financial operation where the broker allows the investor to borrow additional funds for investing after putting down an initial amount of assets (collateral), so the investor can operate more securities than he would be able to by only using his own assets.

The word "margin" refers to the number of assets the trader has to block to receive additional funding from the broker.

Example: A trader would like to buy 1 BTC a the price of $30.000 per unit but only has $10.000 of cash. His broker offers margin trading and is willing to lend him the remaining $20.000 to enter the position.

In this case, the trader’s margin equals his deposit, i.e., $10.000.

To buy an asset on margin, the investor must establish a Margin Account with the Broker. This account acts as a security deposit, called collateral, against which the broker will borrow you additional assets in the form of a loan. In return, the broker usually asks for interest paid on the borrowed funds. Due to the cost of borrowing, margin trading is generally used for short-term investments, as accumulating interest for margin positions will gradually eat into the investor’s profits. As a result, margin trading is usually used for short-term positions.

The collateral asset does not necessarily have to be equal to the traded asset, and margin trading allows one to seek exposure to an additional investment without liquidating an existing position.

“Margin” refers to the amount borrowed from a broker and represents the difference between the buying power and the loan amount.

Buying Power = Own Investment + Margin (Loan)

During the lifetime of a position, the loan-to-value ratio must be maintained. If the loan-to-value ratio falls below a predefined threshold, the broker will request additional funding to secure the loan. The request for additional funding is called a margin call and will be discussed later.

When a position is closed, the proceeds from the trade will go to the broker until the loan is fully paid off and the remainder is paid to the investor.

By using borrowed funds, the investor can amplify his returns on investment. This amplification is called leverage. However, it also means that the investor boosts his risk if the trade goes against him. In a worst-case scenario, this leads to a total loss for the investor.

Who offers Margin Trading?

Due to the complexity, margin trading was traditionally used by experienced and professional traders for many reasons. Over the past decade, online brokerage houses such as Interactive Brokers and Robinhood increasingly started to offer margin trading accounts to retail investors.

In the crypto industry, margin trading is most prominent on large centralized exchanges. Notable examples are Binance, Kraken, and Coinbase. Users usually have to fulfill specific criteria and sign special agreements to be allowed to trade on margin.

Generally speaking, margin trading is becoming ever more accessible to investors and levels the playing field in trading. However, it is imperative to understand that this form of trading is not without risk, especially for inexperienced investors.

What are the Benefits and Risks of Margin Trading?

Now that we know what is margin trading, let’s take a look at some of the benefits and risks of the strategy.

Benefits of Margin Trading:

- Short Selling

- Diversification

- Flexibility

- Leverage

- Hedging

Risks of Margin Trading:

- Leverage Risk

- Margin Call & Close Out

Short Selling

Short selling allows traders to sell an asset they don’t own and thus profit from market declines. When shorting, the trader borrows a currency and sells it in the market. If the asset’s price falls, the trader repurchases the investment at a lower price.

Example: The trader borrows 1 BTC and sells it on spot at the price of $40.000. One week later, BTC trades at $35.000. The trader now buys back 1 BTC and returns it to the lender; his profit is $5.000 (i.e., $40.000 — $35.000).

If the price of the shorted asset rises, the trader will incur a loss when closing the position since the asset is more expensive to purchase than when it was sold.

Diversification

If a trader holds a significant position on a specific asset, he can lend against it to purchase other assets and thus reduce the concentration risk of his portfolio. This strategy works best if the assets purchased on margin have a low correlation to the collateral asset.

Flexibility

Trading on margin allows the trader to engage in additional positions without liquidating existing positions. Margin loans are flexible and can be closed whenever a position that requires margin is closed.

Leverage

In simple terms, leverage allows the investor to amplify his returns by using borrowed funds for investing. As simple as the concept of leverage sounds, it is the most complex feature in terms of benefits and risk associated. I thus dedicate the following section to the concept of leverage and the associated risks.

Hedging

Hedging is a strategy that seeks to limit risk on existing positions by partially giving up the upside of a trade. When hedging, the trader takes an offsetting or opposite position in a related security. Using margin and leverage allows the trader to engage in a hedge without having to pay the hedge outright.

Margin Trading & Leverage

Before diving into the details of using margin for leverage, we need to get familiar with some of the associated terms. Understanding these terms is crucial as they act as variables in calculating the risk exposure a trader can take.

Terminology

For this section, we will use Kraken’s terminology.

Free Cash = Total of free assets not used for collateral.

Collateral = Value of assets that are used to back your trading activity.

Note: Collateral can be any currency and does not have to match the currency of your open trades.

Buying Power = Free Cash + Free Margin.

Trade Balance = Total value of your Collateral.

Equity =Trade Balance + unrealized Profit/Loss on open positions.

Opening Cost =Opening Price x Open Volume.

Current Valuation = Current Price x Open Volume.

Profit/Loss = Current Valuation - Opening Cost.

Profit/Loss (%) = Profit/Loss ÷ Opening Cost x 100.

Initial Margin (%) =% of the purchase price that must be paid with cash.

Used Margin =Opening Cost ÷ Used Margin.

Free Margin =Equity- Used Margin.

Margin Level = Equity ÷ Used Margin x 100.

Leverage = Ratio by which the position is amplified.

Note: Not all of the above will be touched upon in the following sections as this would exceed the scope of the article.

Deep Dive Into the Concept of Leverage

“Margin is a special type of leverage that involves using existing cash or securities position as collateral used to increase one’s buying power in financial markets. Margin allows you to borrow money from a broker for a fixed interest rate to purchase securities, options, or futures contracts in anticipation of receiving substantially high returns.” (source: https://www.investopedia.com/terms/l/leverage.asp)

No Leverage

Without the concept of leverage, the trader uses only his own capital for investment.

Let’s assume a trader has $20.000 in cash and decides to buy 1 BTC (1 BTC = USD 20.000) with no leverage. In this case, the trader uses the entire free cash balance to invest.

As a result, the traders’ total cash is held up in this one trade, and they can not make any further investments.

From a risk perspective, the BTC price would have to fall to zero for the trader to lose his entire investment.

With Leverage

With the concept of leverage, the trader can amplify the returns while at the same time deploying less capital. The required margin is invertedly correlated to the amount of leverage the trader uses.

The below chart shows the impact leverage has on your margin requirement.

For example, by using 5x leverage, the trader only needs to deploy 20% of equity while the broker loans the other 80%.

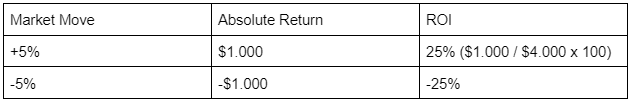

Let’s assume your broker allows you to trade on margin, and you want to acquire 1 BTC with a 5x leverage. Thanks to margin trading, the trader only needs to commit $4.000 to open a position worth $20.000.

Note how by using leverage, the risk/return profile of the trader changes significantly:

While the absolute return remains the same, the return on investment, i.e., the return on the traders’ own funds, has increased by a factor of 5x.

Risks of Leverage

At first, the leverage risk might not be apparent. In the case above, the trader has a large amount of Free Cash that serves as collateral if the BTC position falls in value.

But let’s assume the trader tries to maximize his exposure towards BTC by seeking to maximize his BTC exposure by using 50% of his equity for leverage.

The trader can now seek a BTC exposure of up to $50.000.

Let’s see how market movements affect the traders’ PnL.

Due to the leverage effect, for every 1% in price move, the trader PnL changes by $500. As a result, a drop of 20% in the price of BTC would lead to a total loss for the trader.

As we can see, the main risk of leverage is that not only the gains are amplified but also the losses.

Margin Call & Close Out

Margin Calls and Close Outs are part of the brokers’ risk management system to avoid a worst-case scenario where the losses exceed the trader’s collateral.

A margin call occurs when a trader’s position starts losing value below a certain collateral threshold. In this case, the broker will issue a margin call to avoid the risk of default on the loaned assets, asking the trader to provide additional collateral to back up the open trade.

The threshold for a margin call is usually defined by the risk (volatility) of the underlying asset. Riskier assets offer lower margins and vice-versa.

Let’s assume the margin call level is set at 80%. The broker issues a margin call when the used level reaches that threshold.

In our example, the BTC position can depreciate max. $2.000 or 4% in value before a margin call is sent to the trader.

If the trader does not answer the margin call or the position loses even more in value, the Broker has different options;

- Liquidation of free collateral to restore the margin account.

- Partial liquidation of the position.

- Full liquidation of the position.

As long as the trader has sufficient free cash available to restore the required margin level there is little risk. Suppose he holds multiple or highly leveraged positions and the market turns against him; he might find himself unable to satisfy the margin call and risks defaulting on his entire portfolio.

Conclusion

Previously reserved for professional traders, the concert of margin trading and leverage in crypto allows individual investors to expose themselves to large face values with relatively little capital requirements.

But as compelling as leverage and the resulting returns might be, its risks can be significant and quickly lead to large losses, especially in highly volatile markets. Therefore, being familiar with the concept of margin trading, the various parameters, and mathematical formulas is key.

Successful crypto traders always maintain free cash and operate according to strict risk parameters to avoid margin calls and close-outs at any cost. Traders unfamiliar or new to the concept are strongly advised to use these tools conservatively. Never let greed take over and trade beyond your means or overexpose yourself to the market.

A Word from the Author

Thank you for reading, and feel free to reach out to me or kickstart a conversation in the comments section!

Make sure to subscribe to Attirer and check out my other articles on Medium.com

Join “Inside the Block” on Telegram, Facebook, Instagram, and Twitter to learn about crypto and blockchain (link below).

Disclaimer: Any information in this article is based on my personal experience, out of personal interest, and to my best knowledge and ability. This article has no promotional purpose, does not represent investment advice, and any names, brands, and tickers mentioned in this article are for illustrative purposes only. Use any of the associated links with care and at your own risk. Always do your own research.