Let’s face it, crypto and the wider blockchain industry are going through massive trouble in 2022. While a part of this crisis is industry-specific and self-made, there are larger forces at work too. Geopolitical issues, peak inflation, and ongoing trade disruptions are cooling down the global economy, reducing risk appetite in assets like crypto.

In trying times like these, we see a separation between the strong and the weak. Winners are crowned, and losers disappear into thin air. The concept is simple; it’s survival of the fittest.

In this article, I will explore how the current market environment impacts blockchain companies, what it takes to increase their chances of survival and what mergers, acquisitions, and venture capital have to do with it.

Show Me The Money

“Buy when there is blood on the streets”

— Warren Buffet.

You don’t need to be a market wizard to realize that crypto and blockchain have had a crisis-ridden year so far. From regulatory uncertainty to hacks, failure of entity empires like FTX and Luna, a C-suite exodus, and litigation issues. This not only sent crypto prices to multi-year lows, but it’s also removing a large part of what the blockchain industry is so heavily seeking to build, trust.

Call me wrong, but many failing projects suffer from house-made problems. They are driven by greed and the unwillingness to assess risk properly. Often projects are built on weak foundations from the get-go. In other words, the blockchain industry is ridden with self-proclaimed gurus, ruthless marketers, and investors who are short-sighted enough to follow their every move without asking questions.

While this all sounds awfully pessimistic, the current situation provides an opportunity for the industry and will ultimately ensure the survival of blockchain and crypto. To understand where I’m coming from, we must look back in time.

What the Dotcom-Bubble has to do with Web3

Once in a while, I have a hang for nostalgia. However, history is often the best teacher, and I can’t help but draw parallels to the Dotcom Bubble in the early 2000s.

Back then, the internet was about as old as blockchain and crypto are now and in a not-too-dissimilar stage. In the late ’90s, the internet was still an abstract concept. A few nerds proclaimed it would change the world, corporations were rather critical, and there were little to no rules and regulations. As a result, the industry was fragmented, with no prominent players dominating the market; many startups were overpromising and underdelivering while regulators scrambled to get a grip.

Comparably stable interest and “cheap” money since the mid-90s meant that startups had abundant money coming towards them, propelling some companies into multi-million dollar valuations before even launching a single product or service. Some companies (I won’t be name-dropping here) even managed to list at US stock exchanges solely based on a business plan!

Then, in the late 90s, the FED started raising interest rates amid fear of an overheating economy. Combined with skyrocketing company valuations, funding started to dry up. Lacking a sustainable revenue stream or simply not having anything to sell, many companies began to implode, leaving behind frustrated investors, litigations, and, probably most importantly, a failure of trust in the industry.

Increasing risk adversity also meant investors started to pull out funding and protect profits, starting a selling frenzy in tech stocks that soon would spill over into other risk assets. Ultimately leading to a “tech winter” and what analysts would later call a mild recession.

The dotcom bubble is also associated with the NASDAQ Composite index, which rose by 582% from 751.49 to 5,132.52 from January 1995 to March 2000. The NASDAQ fell by 75% from March 2000 to October 2002, erasing most gains since the bubble started building. - Corporate Finance Institute

It was a real Tech-Rush, culminating in a near disaster for an entire industry. So what were the drivers behind the bubble in the end?

- Overvaluation of companies

- Abundance of capital

- Media frenzy

Does that sound familiar?

There and Back Again

Despite the despair in the tech industry, not all was doomed. The Dotcom crisis led to a slew of new regulations leveling the playing field, protecting investors, and opening opportunities for solid projects to prosper.

It soon became clear that the dotcom bubble didn’t burst because of the flawed underlying technology but because of the projects and frameworks built on and around it.

The internet was here to stay; the only question was in what form and shape. If I were to draw a parallel to nature, I would compare it to a forest fire. Although devastating, it can have a cleansing effect, providing fresh fertile soil and space for the forest to regrow, stronger and more diverse than before. It may take years, but time is a relative construct, and in the grand scheme of things, even a decade is a mere blip.

Another interesting fact is that rarely all trees vanish in the fire. The weak and ill-rooted will perish; the strong will sustain, injured but alive. And it’s them who will bring new life to the forest.

Ironically startup companies are often victims of something called “burn rate.” The burn rate defines how quickly a company spends its available capital. And you may have guessed it, operating solely on hopes, seed funding, and venture capital is not a sustainable business plan. It may go well for a while, but it will inevitably lead to failure if the climate becomes more hostile and funding dries up.

Survival of the Fittest

In my humble view, the crypto-winter is strikingly similar to the Dotcom Bubble. While many agree that distributed ledger technology has great potential, the industry is still in its infancy, living a similar boom and bust moment to the internet some twenty years ago.

And while funding gets increasingly expensive and capital is harder to find, cracks have begun forming in the blockchain industry’s shiny armor. Let’s look at some of the earlier-mentioned issues the blockchain industry faces before we evaluate how this will affect companies and their funding going forward.

The C-Suite Exodus

We see reports of many figureheads leaving the space or at least stepping away for the time being. CoinDesk recently dedicated an article to this phenomenon:

This raises some critical questions;

- Why do the captains leave their seemingly intact vessels?

- What does that mean for the companies, the people, and the stakeholders that are left behind?

- Were all these projects illicit from the beginning and simply an attempt to fill the pockets of a few good marketers while nobody was looking?

Especially in the start-up industry, companies thrive on C-suite management and leadership skills rather than the actual success of the underlying business. Having a robust C-suite reputation often is the make-or-break factor when raising capital. You can have the best project or idea in the world, but without a shining figurehead to promote it and make it a reality, you will find it extremely challenging to raise capital in the first place.

A leaderless company is also likely to face backlash from new and existing investors, creating difficulties in attracting new capital and, in the worst case causing a drain of funding.

The Lack of Transparency

This is controversial but nonetheless the most interesting. Blockchain and crypto, in particular, praise themselves for delivering unparalleled transparency. These days, however, many projects fail precisely because of the lack thereof.

What good is an underlying technology that is supposed to be transparent when the projects and gatekeepers are not? TradFi went through the Lehman Brothers fiasco in 2008. Why it took the FTX-sized scandal to convince crypto exchanges to declare their safety procedures and reserves? Have we not learned from our past mistakes?

On the other hand, we still see “investors” throwing their money at anything that promises a quick bang for the buck. I hate to break it to you, but if it sounds too good to be true, it probably is.

Intransparent business practices, combined with a general risk-off sentiment, potentially impacts funding and acquisitions. Again, FTX comes to mind; Binance initially intended to acquire the failing exchange to protect the market’s integrity. Within days, however, Binance backed out, stating that the complexities of FTXs problems were unsurmountable and could ultimately hurt their own business, leading to an even greater fallout.

The Lack of Regulation

Again, the views differ heavily on this one. My take is this: While too much regulation can curb innovation and make a market exclusive, no regulation leads to anarchy, harming everyone but the ruthless.

And yes, I keep bringing this topic up in many of my articles because meaningful regulation is vital for future blockchain adoption and crypto’s survival.

From a capital venture perspective, a non-regulated market is challenging to navigate. It makes risks less quantifiable and hampers the ability to assess an investment properly. Regulatory uncertainty can mean that a potentially lucrative investment fails without warning.

The Cost of Capital

If you want to start a company, capital is one of the cornerstone requirements. Over the past decade or so, that was an easy task. Besides a few hiccups here and there, the global economy was firing on all cylinders, fueled by cheap money. Taking out a loan or seeking capital was simple and almost free. But soon, the abundance of money took weird turns. Regardless of the risk, people would throw money at anything that promised a return.

We could go into lengthy details as to how to value companies and what the effects are, but that exceeds the scope of this article.

Simply put, cheap money (i.e., low-interest rates) means lower discount rates and, thus, higher company valuations. When central banks suddenly start hiking rates aggressively, let’s say to fight inflation, company valuations based on discounted cash flows begin to fall. (If you’re unfamiliar with discount rates and cost of capital, click the link.)

The main takeaway is that rapidly changing company valuations considerably affect the ability to secure funding, maintain operations, and growth perspectives.

So, what does all of this mean for the blockchain industry?

The Consolidation Effect

Again, let’s dwell on the past for a moment. As ruthless as the Dotcom bubble burst was, some companies were capitalized and structured well enough to survive. And in the early 2000s, they started to open their war chests, going on a spending spree searching for talent and affordable but promising projects. Google, Amazon, Priceline, Microsoft, and Apple, anyone?

What resulted was a rapid consolidation of the tech industry, away from fragmentation to a few prominent behemoth players. The birth of the era of Tech Unicorns. Some of them became so powerful that they would go on to pretty much dictate our everyday lives, leading to a whole new set of problems.

But lessons from the bubble burst had led to new rules and regulations that until now prevented Web2 from repeating its early mistakes. Although some issues remain, web2 has finally found maturity.

So far, the blockchain industry has shown a strikingly similar development, and looking at the history of M&A in the blockchain space leads to some interesting theories.

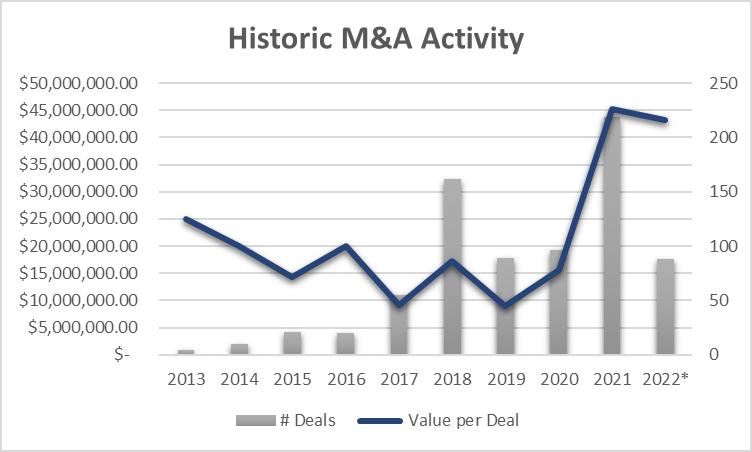

M&A Activity 2013–2022

While M&A deal activity seems to have peaked in 2021, the average value per deal remains at all-time highs. Between 2016 and 2020, the average deal size was around $20m. This number almost doubled in 2021 and seems to have yet to retreat much in 2022. One interpretation is that buyers are still willing to pay large amounts but are more specific about what they acquire. Another theory is that more projects are prone to failure due to falling crypto prices, leading to fewer buying opportunities in the market. Assuming buyers’ appetite outpaces the supply, we could conclude higher competition and, thus, higher acquisition prices for high-quality deals.

M&A Activity Outlook

The jury is still out on whether the higher average price trend is continuing. Recent global economic uncertainty and impeding additional regulatory requirements for crypto and blockchain may hamper dealmaking in the short term. On the other hand, further scrutiny and demand for transparency may accelerate M&A activity over the medium term as prominent players seek to vertically or horizontally integrate businesses to help cope with new (legal) requirements.

Supporting this thesis is a recent report from TokenData showing a clear difference between Strategic M&A* and Financial M&A** activity. While the 2018 and 2021 market was heavily driven by Financial M&A, the momentum has shifted towards more strategic acquisitions. This seems logical in times of high financing costs, uncertainty, and low demand for risk assets.

Strategic acquisitions seek to improve operations, lower supply chain costs, and strengthen an existing player. Large players with substantial balance sheets will seek to integrate competitors and potential disruptors to gain an advantage. A good example here would be acquisitions from TradFi companies that seek to integrate crypto and blockchain providers in an attempt to enter the market. From a strategic perspective, there are better chances of finding a good deal in a demanding environment.

On the other hand, financial acquisitions are more like a bet on a company’s future success. Often the interest of the buyer is purely financial and a speculative bet. An uncertain industry outlook diminishes the prospect of future returns and, thus, reduces Financial M&A transactions.

*Strategic M&A; Companies deciding to make acquisitions to strengthen their brand further or eliminate competitors by vertical or horizontal integration

**Financial M&A; Acquisitions made by financial companies such as Private Equity companies and SPACs.

As a result, we will likely see a consolidation in the blockchain space where many smaller players get integrated into larger, more dominant companies. Another driver for consolidation is that increased funding costs make it difficult for small projects to survive on borrowed assets, and some will have to take life-line funding at steep valuation discounts or risk perishing.

The question remains whether the ongoing consolidation in the Web3 space leads to a similar situation we’ve seen in Web2, where a few control the many. And more importantly, what does that mean for the decentralization aspect of blockchain technology?

Before we answer that questions, I want to briefly touch on Venture Capital (VC) since this is an essential source of funds for many projects.

The Venture Capital Situation in a Nutshell

After a highly active 2020 and 2021, the current year is undoubtedly different regarding VC funding. During the past years, the landscape was lively and attracted large and small investors. However, I see an increasing shift in the landscape. VC is a game of risk and most profitable if you are right about your assumptions. The fragmented and increasingly complex landscape of blockchain and crypto favors VC investors with substantial resources to assess investment opportunities and quantify associated risks.

To secure funding, blockchain companies must up their game, deliver on their promises, and provide transparency. Going forward, the money will flow to projects that solve real issues and bring added value to consumers.

Lastly, VCs constantly look for a good deal. The current turmoil has a cleansing effect and hopefully removes more and more bad actors from the market. As a result, it will become easier for VCs to find suitable opportunities.

If you sit on the other side of the table and ask yourself how to attract funding, here are a few thoughts on how to position yourself;

- Ensure your business operations are transparent and understandable

- Be accountable, i.e., stakeholders must be able to address concerns, and someone needs to carry the responsibility for the project

- Do not overfund your project in the beginning; high company valuations lead to high expectations from investors and stakeholders

- Provide a solution to a real issue and highlight the benefits of your solution. → Don’t lead your pitch with Crypto or Blockchain as the main driver for your project. Focus on the value add of your solution and how Web3 supports this.

- Start small; focus on a specific problem, make it work, and only then focus on scaling.

- Pay attention to the user experience; Web3 is still a niche industry, and the biggest growth potential comes from attracting first-time users by lowering the entry barrier for them.

Risk & Opportunity of Decentralization

The definition of decentralization is at the very core of the whole blockchain debate. As I mentioned earlier, I support the concept of not having a single entity controlling too much. Still, on the other hand, I am happy to partially delegate some responsibility in return for comfort and ease of use. But that’s a personal preference.

The Risks

The initial purpose of the internet was to simplify knowledge transfer and improve global communication. But information is a powerful tool, and whoever wields control also holds enormous responsibility. It became clear that the main drawbacks of Web2 after the consolidation in the early 2000s were transparency and centralization of data control. The idea of loosening things up with blockchain technology thus seems appealing. But we must be careful that we don’t blindly follow a new Messiah simply by the promise that they will do better than before.

The Opportunity

Web3 undoubtedly has great potential to increase transparency, efficiency, and how control of information is exercised. By introducing protection mechanisms in combination with meaningful rules and regulations, we can correct the flaws of Web2. Consolidating power, through M&A or otherwise, is not necessarily a bad thing. It can help to create efficient, vertically integrated solution providers, reduce development costs, build industry standards and create ease of use. But we must ensure that those who consolidate the power can also be held responsible in case of misconduct through transparent business conduct, reporting requirements, voting rights, or other means of participation from stakeholders.

Conclusion

The current state of blockchain is complex, no doubt about it. But it equally provides tremendous opportunity. While blockchain technology faces headwinds, it is unlikely to vanish. However, what will change is how the industry looks today.

Increasing popularity and adoption will continue to attract capital as players seek to enter the market at discounts. There is a likelihood that increases in Strategic M&A activity will lead to more consolidation as companies vertically and horizontally integrate. The critical point here is that blockchain technology provides the means to create the necessary transparency needed to keep these big players on tight reins. No matter how much data you control, if anyone can see what you do with it and you can be held accountable for misconduct, you are much less likely to abuse your power.

And to come back to Mr. Buffets’ quote, who wouldn’t want to buy into a solid Web3 project at a significant discount?

The Yellow Network provides an exciting example of how consolidation can lead to more transparency. As a peer-to-peer liquidity aggregator, the Yellow Network seeks to connect brokers and liquidity providers across different networks and protocols, thus deepening liquidity and providing increased transparency to a siloed and fragmented market.

Check it out by clicking the link below

A word from the Author

Thanks for reading! If you liked the article, make sure to tap that subscribe button for more stories from Attirer!

I hope you had a good read on this independent analysis by Inside the Block for the Yellow Network. Feel free to contact me or kickstart a conversation in the comments!

Disclaimer: Any information in this article is based on my personal experience, out of personal interest, and to my best knowledge and ability. This article has no promotional purpose, does not represent investment advice, and any names, brands, and tickers mentioned in this article are for illustrative purposes only. Use any of the associated links with care and at your own risk. Always do your own research.

Discover Web3 and Dive into DeFi with Yellow Network!

Yellow powered by Openware is developing an unprecedented worldwide cross-chain P2P liquidity aggregator Yellow Network, designed to unite the crypto industry and provide global remittance services actually helpful to people.

Are you a crypto developer? Check out the OpenDAX v4 white-label cryptocurrency exchange software stack on GitHub, designed to launch market-ready crypto exchange brokerage platforms with a built-in liquidity stream.

Join the Yellow Community and dive into the most product-oriented crypto project of this decade:

- Follow Yellow Twitter

- Join Yellow Telegram

- Check out Yellow Discord

Stay tuned as Yellow Network unveils the development, technology, developer tools, crypto brokerage nodes software, and community liquidity mining!